I myself am a member of a credit union that doesn't play nice with Mint. Luckily for me it's not my primary account and I do not keep much in it. But if you are like Sarah and cannot take advantage of Mint for this reason there are a couple different directions you can take. They may require a little extra effort to set-up, but once you get comfortable they will be just as easy to utilize. Since the topic of this posts risks an extremely long post I will only focus on Excel today.

Personally, I love Excel. It's practically made for budgeting and is easy to use once you get familiar with it. The problem with excel is that it's best asset is also its worst. Excel is a blank slate, you can use it for whatever your heart desires to track which automatically makes completely overwhelming. The key to excel is keeping it simple.

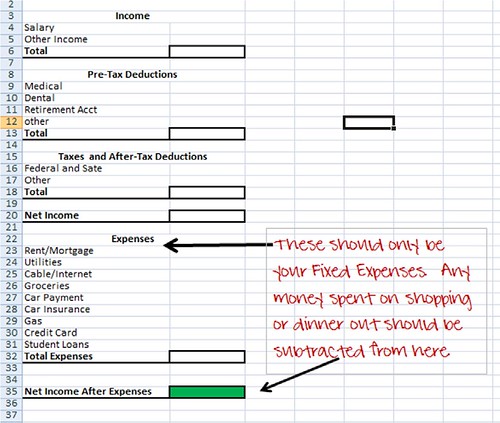

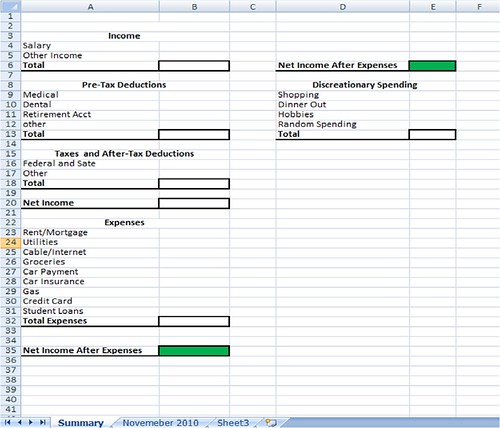

This is a pretty basic buget template you can do in excel. I recommend being as detailed as possible when it comes to your fixed expenses. You can expand on this template by carrying over your "income after expenses" into a new colum that tracks your discretionary spending.

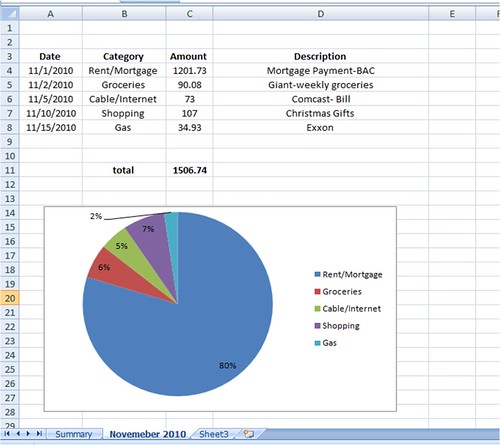

Within the same workbook you can also keep a sheet to track your spending each month, similar to the transaction page you would find on Mint or in Quicken. You can even make a sweet pie chart to go along with it so you can see what percentage of your spending each category occupies.

Some things to keep in mind when using excel:

Make it a routine: Don't wait until the end of the month to plug everything into your spreadsheet. It is both sucky and time consuming and really does little in the way of helping you attain your goals. I would recommend setting time aside once a week to update your monthly budget and spending diary.

Make it your own: Just because something works for me does not mean it will work for you. Build a budget that suits your needs.

Keep it simple, stupid: As in don't over-complicate things. The budget page should be a guideline for how you should be spending. Use your transaction sheet to get into the nitty-gritty of your spending.

As you get more comfortable with your excel budget you might want to add some extras to your budget page. For example, I like to have everything in one place so I would include my savings goal for the year and actual balance, the remaining balances of my credit cards and student loans, and a list of dates for bills that may not come monthly like my car insurance and water bill.

So Sarah, and anyone else in her situation, I hope this helps. If you don't think excel is right for you, have no fear, my next topic.. Budget Software.

If you have any questions on how to set-up formulas or charts in excel, feel free to contact me.

*I am in no way a financial professional. This blog is strictly an expression of my opinion and reflects my own use of personal finance. For advice on investing and finances please contact a licensed professional. Thanks.

Thank you so much...this was a HUGE help!

ReplyDeleteWhat do you think about money strands?

ReplyDeletehttps://money.strands.com/content/fast-simple-and-free-budget-planner

Thank you so much for this! I really needed to make a budget and this has helped so much!

ReplyDelete"Keep it simple, stupid" That sounds so familiar.. is it the slogan from some popular finance course or something?!

ReplyDelete