I'm going to tell you guys something that I'm not too proud to admit. I've had a serious case of the "I Wants" lately. My shopping has been creeping out of control and has been taking focus away from my financial goals. Having a new jacket or shirt or shoes has started to take precedence over my debt payments. Clearly not the direction I want to be heading. I need to get my financial house in order and really focus on implementing action steps in order to reach my goals and attain financial freedom. In order to do that I decided to use an exercise similar to the one Jess from JessLC used to sort through her worries by modifying it just slightly.

There are tons of financial goals swirling around in my head right now including paying off student loans, saving for a wedding, and saving for retirement so I needed to narrow my focus. I chose to limit this exercise to the three most pressing right.

There are tons of financial goals swirling around in my head right now including paying off student loans, saving for a wedding, and saving for retirement so I needed to narrow my focus. I chose to limit this exercise to the three most pressing right.

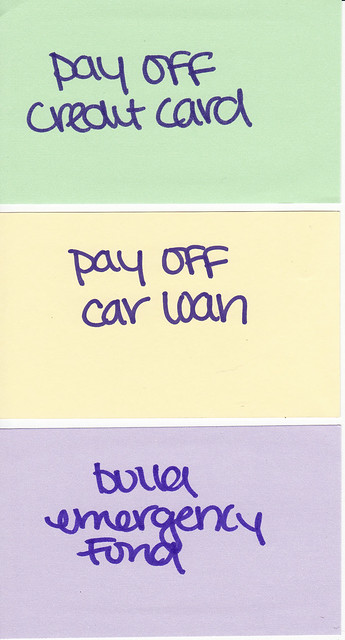

First I wrote out what those three financial goals were.

Then, I wrote out the dollar amount of the goal (how much I owed or wanted to save) and what I was currently paying towards that goal.

Third, on the back of each card, I established action steps for achieving my goal and a target date for it's completion.

The way I determined my target date was by using the present value, expected future value (0 for my loans) the interest rate, and various payment amounts to derive the number of time periods different payments would achieve. I tried to use payment amounts that were realistic for me and my budget now so I did not take into account any future salary increases or other forms of income. My target dates are set by simply by me doing the minimum. Any extra amounts of money thrown at these goals would result in achieving my goal sooner (major incentive).

Fourth, I put them on the wall next to my desk, a place that makes it impossible to lose sight of them.

The 5th step now will be to go back every few months and evaluate my progress and set new target dates depending on how well or not so well I'm doing.

That's it. That's how I spent my Saturday morning. I feel better though, more in control than I ever have been. Seeing the numbers written out in front of me and taking the time to do the math and see the results in months on how long it will take me completely kicked the crap out of the "I Wants". I'm totally focused on the prize... zero consumer debt and a healthy emergency fund.

I've been having a severe case of the "I Wants" lately too. So you don't know HOW invaluable it was for me to see this post today. Thank you. I'm going to try the postcard trick when I get home.

ReplyDeleteI have been feeling the same way! All the sales and the change of season have really made me want to overspend. It is so great that you are so honest with yourself (and us!). This seems like a great idea to help me get back on track as well. Thank you so much for posting this, it has been the kick I need to stop spending as well.

ReplyDeleteIts really hard to plan out a budget or savings plan and stick to it.....I commend you for your re-focus:)

ReplyDeleteGood luck!

Enter my awesome Tulle giveaway♥

Omg, I've done the same thing, but I'm afraid to go back and actually see if progress has been done. This post has given me the courage to do so though, thanks!

ReplyDeleteI also think little rewards here and there would help to. If you say to yourself, NO FAST FOOD/"OUT OF FRIDGE" purchases as I like to call them for a week, if you accomplish.. next week, get yourself a latte or whatever.

Makes things at least a little more interesting!

thanks for posting this. it inspired me to make a budget and set some financial goals for myself. i've been thinking about it for a while, but now i've finally put my goals/budget on paper & hopefully will stick to them.

ReplyDeleteThanks for this! I need to do exactly like you've done here. I have school bills to pay off (undergrad and now grad!), car loan and emergency fund. I only have 1,500 in my fund. I need to start saving!

ReplyDeleteSuch a great plan to get out of debt. Just a thought - have you considered not getting the full amount from your student loan, so you won't have to pay that back later as well? That is what I am struggling to get rid of now!

ReplyDeleteYou have a great blog and look like a high fashion model!

This is such a great idea. I did something similar, but the list isn't visible at all times. I think that's the key. I'm going to work on revisiting my financial goals and tracking my progress more visibly over the weekend.

ReplyDeleteKendra

http://closetconfections.com

So here's the story of who I am. I am in your Risk Management class at Loyola...I wandered onto the message board for class to see if anyone had posted their paper...for some reason I clicked into the introductions. I stumbled across yours and saw the link for your blog. I thought it was random looking so I was like I bet this is going to be a good laugh...HOWEVER, I was pleased to find that this is a fantastic blog to read! It is the important stuff that women really care about. Instead of complaining about love, babies, and household chores...you talk about realistic things that really matter...Money and clothes :-) I just wanted to commend your talent and the time you spend on the blog and I will happily continue to read! Keep it up!

ReplyDelete