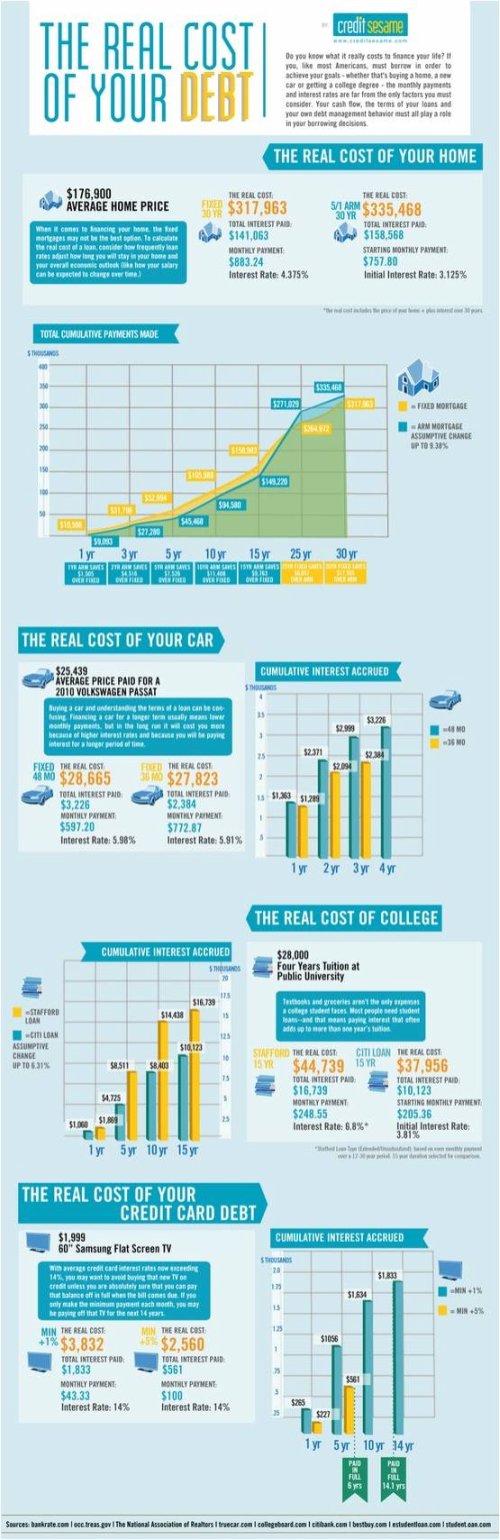

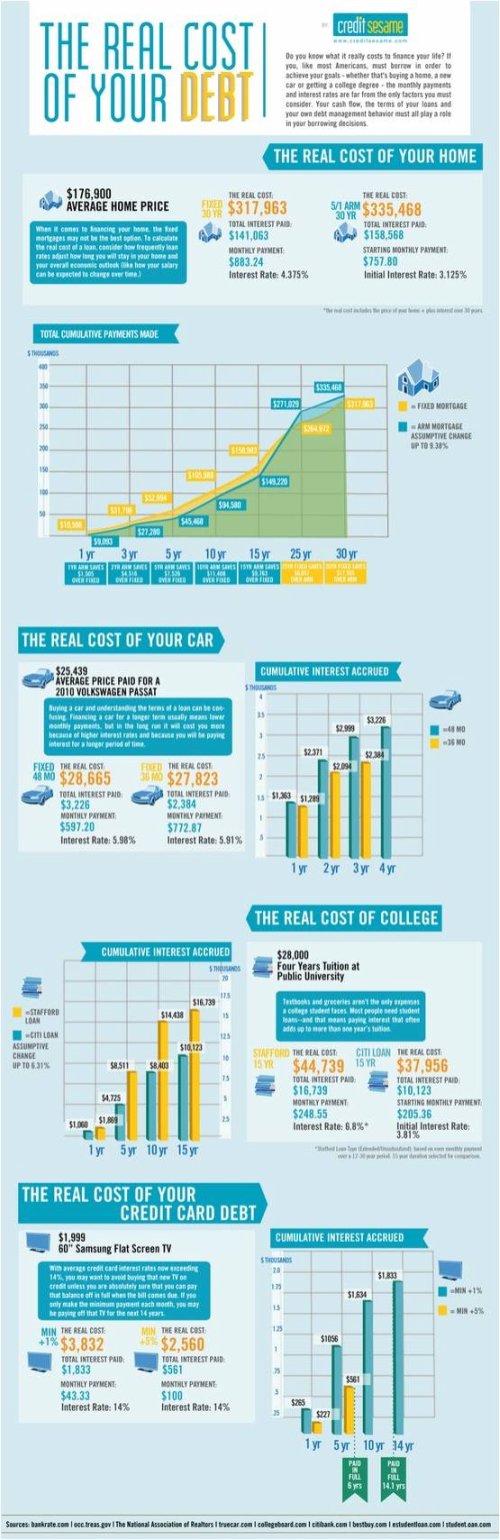

Ok, so you caught me being lazy this morning. It's only the first week of class and I am already falling back on an info graphic for my obligatory finance post. Before you run off and skip to the next blog in your reader, just look over it, just for a minute. Most people think of cost in terms of price but when you are financing a purchase whether it be a home, car, new wardrobe, or an education you have to think in terms of the real cost. The real cost being principle and interest. And trust me there is always interest. It sounds crazy, but I know I could blab on and on and on and not be able to evoke the "oh shit" factor this thing does. If you are in debt, use this as motivation to get out. If you have no debt, be proud of where you are. And if you are like me, on the brink of paying off a load of credit cards, rejoice that it will soon be over (and come up with a plan to pay off your car asap!)

I don't expect to get a lot of comments today, but leave some thoughts about how this makes you feel. Do you consider the "real cost" of a purchase before you make it? How do you deal with financing? Do you pay only the minimum?

[if you have trouble reading it, click on this image to take you to the original]

No comments:

Post a Comment

Thanks for stopping by Money Smart Fashion!