For those of you that don't remember or are new to the blog each month I attempt a new personal finance "method" in an effort to pay off my debt, add to my savings, or just control my spending, whatever strikes my fancy. This month I am giving a go at "Snowflaking". A derivative of the debt snowball, snowflaking is taking the small sums of money that are left over from your budget at the end of the month and applying them to debt.

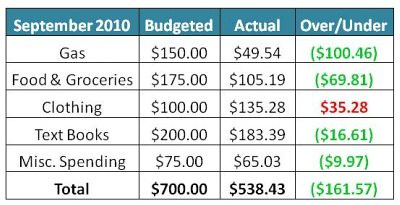

Here is where I stand as of end of day Tuesday (pardon the crappy graphic):

Some thoughts:

1. Eek! Over on clothing already?! I'm not surprised. After taking a free group personal training class this summer I decided to join the gym at work (so I could take it again, for free). I kind of went a little crazy buying some new items to prepare for impending fall temperatures (it's outside). A majority of this budget was spent at Under Armour, I love employee discounts.

2. I've had a lot of miscellaneous spending this month. One third of the budget went to buying a books both for me and SSBF so I could get a could start on my birthday goal of reading 6 books this year. I realize that we could have just gone to the library but I just love cracking open a brand new book to read.

3. I came under on textbooks! Thank you jesus. However I am still peeved that $60 went towards a freaking financial calculator that I will never use again!

4. Gas is on track to be $30 under for the month. I typically fill my tank every 7-10 days, at $35 a fill, even if I have to have to fill up twice before October that is $120.

5. Food has turned into "food and utilities". Typically I give SSBF $90 towards groceries each month however we received our quarterly water and sewage bill this week which was fr $85 (normally $60) so I am paying that instead of paying for groceries. Anyway even with that I can see $15-$20 dollars under.

Overall I am feeling pretty good. At this point anything I can put towards my debt is helpful because the interest I am paying makes me cringe. It's sounds dorky, but keeping tracking of my spending this way has made me want to come in under budget, more then I ever have before. I think it's my competitive nature, I must win! I must beat this!

Wow! Congrats on staying within your budget for the most part... I know what a challenge that can be :) Keep up the good work!

ReplyDeleteNice way to track spending! I should try this!

ReplyDeleteHow about investing in a kindle for reading? Pay like $139 one time and youcan download books to read to it. I believe the downloads don't coat that much and you can hold hundreds(?) of books on it.

ReplyDelete